FOSTERING ALIGNMENT TO UNLOCK OPPORTUNITIES

As we reflect on another great year in the books, we are proud to have practiced what we preach to truly ignite growth and build enduring value, as reflected in the incredible momentum across our portfolio. We closed two platform investments, completed two successful exits, one resulting from the successful raise of a single-asset continuation fund and welcomed many strategic add-ons to our expanding portfolio companies.

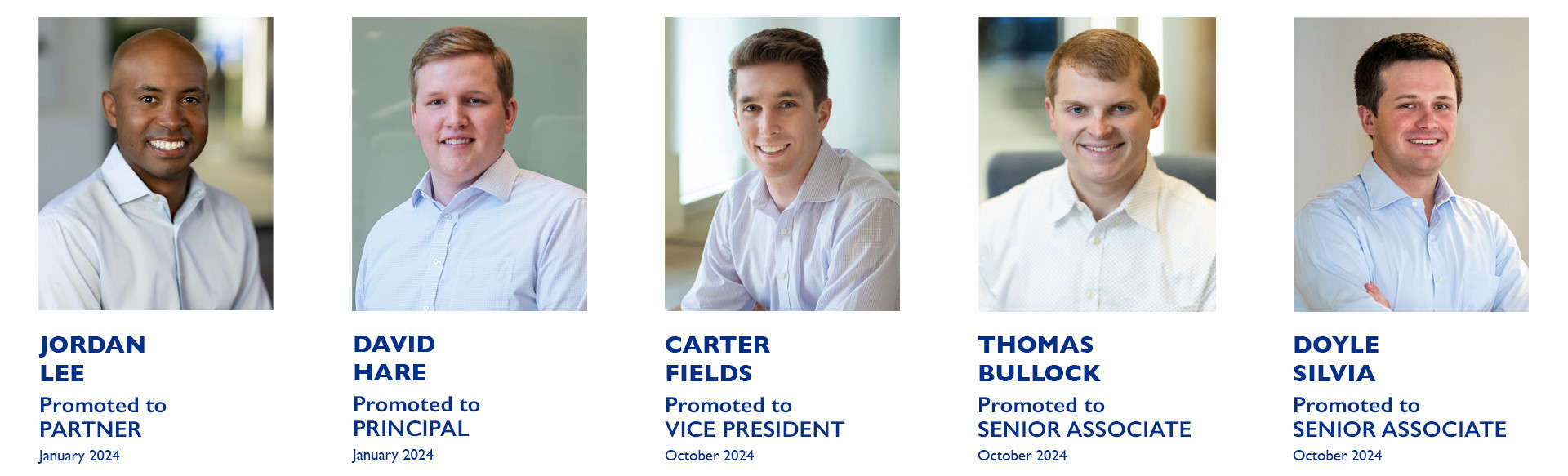

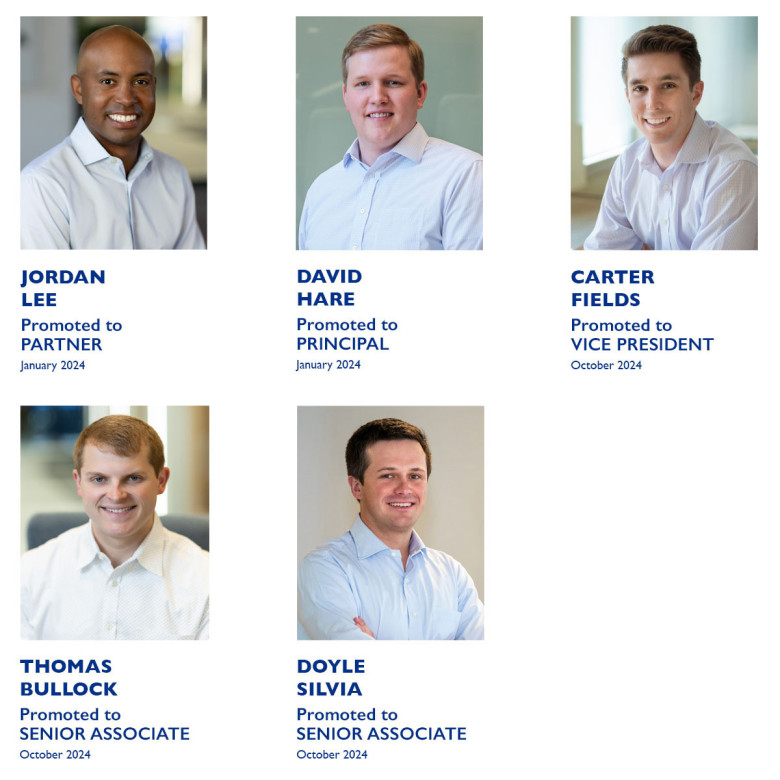

Despite the busy moments of 2024, we also took time to celebrate our team’s wins and honor their dedication to the firm. Five outstanding team members received promotions this year. Outside of the office, three team members welcomed new babies into the broader Kian family!

As we turn the page to 2025, we extend our deepest gratitude to our portfolio company management teams, investors, deal partners and our own Kian team. Their tireless dedication is the foundation of our collective success, and we are extremely thankful for everything they do.

2024 PORTFOLIO HIGHLIGHTS

In 2024, we invested in new platform companies and added to our current portfolio. Here are some portfolio highlights:

Kian Invests in US VisionMed Partners

Alongside RF Investment Partners, Kian announced the formation of an MSO supporting established, medically-focused optometry practices nationwide.

The Purple Guys Exit Creates Market-Leading Pure-Play MSP

Kian’s Blueprint for Enduring Value and commitment to building genuine partnerships with company owners were instrumental in driving a successful outcome.

Exponential Growth for PARC Auto

Kian-backed PARC Auto became the largest Meineke franchisee, expanded its executive team, and entered new markets in just over a year since partnering with Kian.

SPATCO Platform Continues to Expand

The company, now part of Kian’s first single-asset continuation fund, completed three add-ons in 2024, including Blue1 Energy Equipment, Hobby Electric and UST Services Corporation.

Team Air Platform Growth

Team Air acquired Best Choice Supply Company and entered the Georgia market with its second territory expansion award from OEM partner American Standard.

Sdii Adds Roar Engineering to Forensics Platform

As a combined platform, the duo represents an industry-leading forensic engineering services provider, offering considerable geographic and portfolio breadth and depth.

Kian Makes Platform Investment in Eden Brothers

Kian completed the acquisition of Eden Brothers, a high-growth e-commerce retailer specializing in flower seeds and bulbs for enthusiast gardeners nationwide.

Kian Announces Combination of Portfolio Company Labor Law Center with OutSolve

The combined entity has a powerful, comprehensive suite of compliance solutions to better serve customers and position the business as a clear leader in the space.

FIRM HIGHLIGHTS

With the remarkable growth our firm has experienced in recent years, we’ve deepened our bench to further support our portfolio companies, offering resources and experienced partners to assist in achieving our shared goals.

INVESTMENT CRITERIA

We deploy flexible and creative capital that aligns with our philosophy of creating relationships where everyone wins. With a focus on lower middle-market opportunities, we think in terms of what is right for each situation and can offer equity and mezzanine debt in structures that offer innovative solutions to each company with which we partner.

Learn More About Kian's Investment Profile

or contact David Duke, Partner, Business Development, at

dduke@kiancapital.com